Ever since the COVID-19 pandemic began, people have feared that a financial crisis is coming – because according to experts and their statistics, we should experience a global crisis every ten years. Financial crises can be of various sizes, from general global disasters to just six months of negative GDP. For example, in 2020, when everything shut down, most countries had two-quarters of negative GDP, which was felt especially in the industries most affected by the quarantine: hospitality and tourism.

To avoid a financial crisis of proportions, a lot of new money was printed by governments – an action that increased the asset prices (of both the cryptocurrency and the stock market) to record levels never reached before. However, these prices “came back down” once inflation peaked. Given that our recent financial history also involves the 2008 financial crisis, which had an extreme impact on every sector of the economy, people still fear that the situation may worsen.

What are the five things that we should pay attention to?

It’s important to remember that every trend starts in The United States (and other powerful countries worldwide), reaching the rest of the globe later. For example, in 2009, the working class still did not feel the trouble – instead, they had a hard time with available jobs and unemployment only in 2013, while the American economy recovered much faster. It is usual for emerging countries to behave like this due to weaker economies, so we will use The United States for reference from now on.

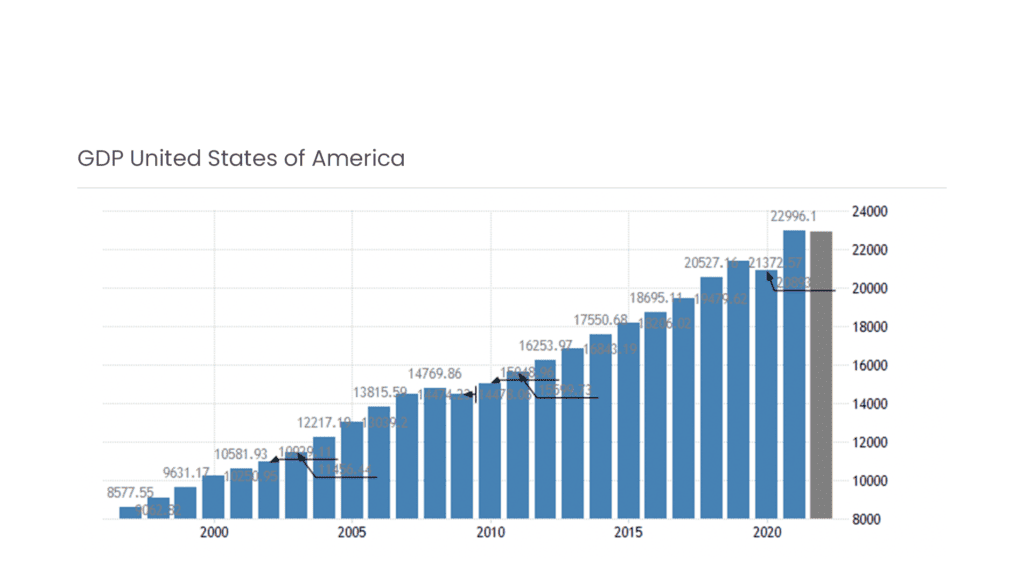

The GDP

The Gross Domestic Product fell for the second consecutive quarter, and The United States is in a technical recession. “Technical” because the data shows a recession, but there is still a lot of money and liquidity in the markets to feel the adverse effects. The GDP is calculated by the difference between the actual level of production and the potential level – because the economy can only grow if the existing resources in a society are fully used. If the number between these two increases, we may face a looming recession. The simple calculus mentioned above has been among the most common recession calculation standards since 1974 when Julius Shiskin invented this theory.

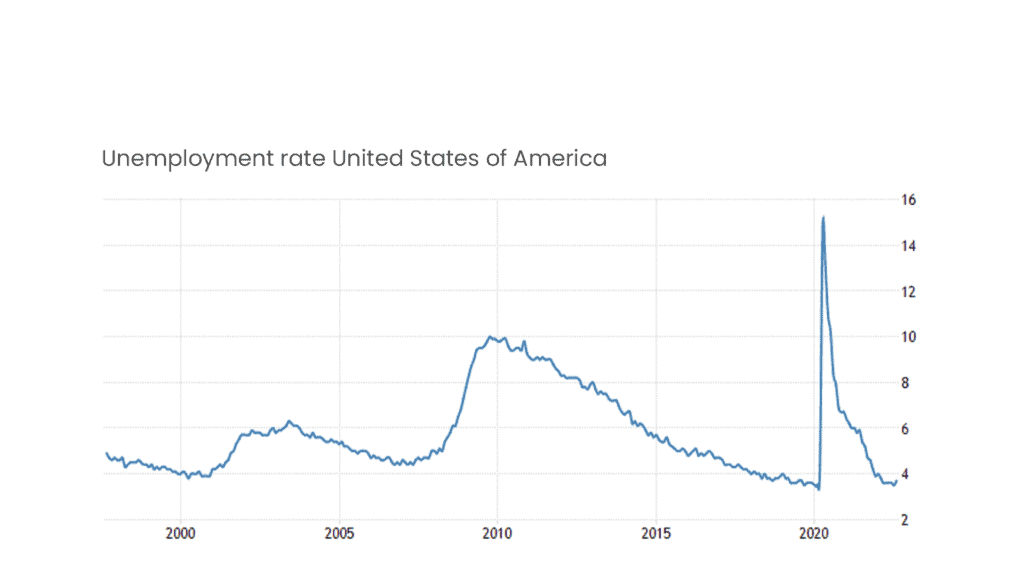

Unemployment rate

A high unemployment rate indicates that there are not enough available open jobs because businesses are no longer producing at the same high capacity. This can happen if respective companies are over-indebted and interest loans are rising. Financial pressure decreases demand and production during a financial crisis, deepening unemployment, and vice versa. It is a cycle in which people are constantly laid off, and thus the recession is deepening. This is also why the Federal Reserve has continuously increased interest rates. The United States and the rest of the world immediately felt these increases. However, it’s up to the US to take further steps to keep inflation under control.

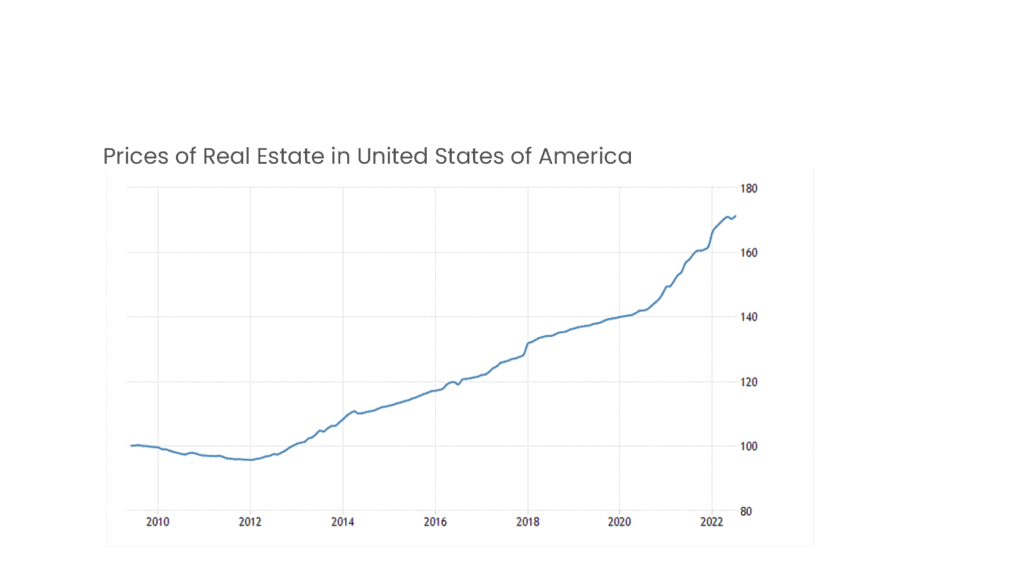

Real Estate

Although real estate is a robust and tangible asset that can provide passive income and increase in value over time, the real estate market can drop significantly in a recession. Real estate prices have already started to decline in the US, and the rest of the world is following (regardless of the percentage). This is given both by higher interest rates and by inflation, unemployment, or simply the declining interest of people who no longer see value in investing in an inflated asset.

Oil Price

A safe haven asset like gold or the Japanese Yen is also oil – which’s situation worsened after the 2020 quarantine when the travel and tourism industries suffered a significant decline. The sudden and high rise in oil prices means that many sectors requiring transportation have faced significant difficulties. Thus, the prices of products and services have increased so that the businesses could continue producing at least at the same pace and still support the workplaces – leading to higher inflation and a lack of consumer confidence. The oil price skyrocketed from $70 in December 2021 to over $120 in March 2022, reaching almost $110 in June and $90 at today’s prices.

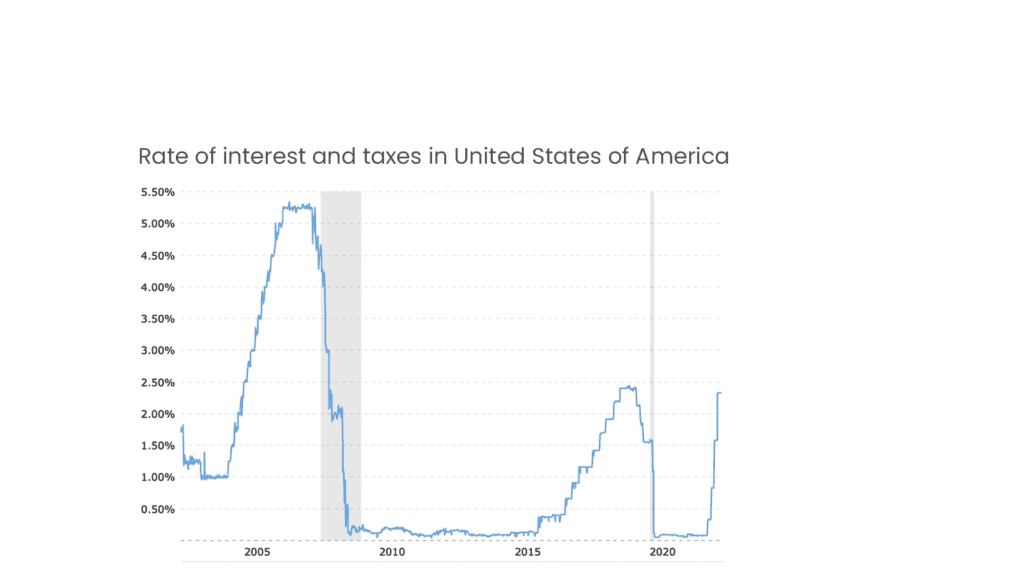

Rising Interests and Tax Hikes

Interest hikes are meant to keep inflation under control, and taxes are intended to raise more money for the budget. When inflation goes up a lot, it creates gaps in the budget because everything costs more money. Higher interest rates and taxes translate to less money for business growth, marketing, or salary increases to support inflation or other important economic factors.

Anyone can be an investor. On a global scale, crypto remains a relatively young asset class with an investor base that’s still growing. At IXFI, we’re building a community where everyone is welcome. We mean it when we say that anyone can be an investor. Try it for yourself; join Your Friendly Crypto Exchange today and see where you fit in.

Disclaimer: The content of this article is not investment advice and does not constitute an offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not consider your individual needs, investment objectives, and specific financial and fiscal circumstances.

Although the material contained in this article was prepared based on information from public and private sources that IXFI believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein. IXFI expressly disclaims any liability for the accuracy and completeness of the information contained in this article.

Investment involves risk; any ideas or strategies discussed herein should, therefore, not be undertaken by any individual without prior consultation with a financial professional to assess whether the ideas or techniques discussed are suitable to you based on your personal economic and fiscal objectives, needs, and risk tolerance. IXFI disclaims any liability or loss incurred by anyone who acts on the information, ideas, or strategies discussed herein.