The year 2021 was big for the crypto industry as it witnessed many new players investing for the first time. So, as crypto gets to the mainstream, it becomes essential to know what key considerations will be needed, like tax reporting provisions for digital assets in the US.

If you aren’t sure about filing your crypto taxes, don’t worry, as you are not alone. Crypto is still a new place for many to explore, so finding tax professionals with the right expertise can feel daunting.

This article simplifies the crypto tax process by breaking it into easy-to-follow steps. Also, read on to learn which activities to report and how you can plan for your taxes.

Activities To Report On Your Tax Returns

· Purchasing Crypto With US Dollars

· Using Cryptocurrency As An Exchanging Method

· Creating or Trading NFTs

When Do You Owe Taxes on Crypto

Because the IRS counts digital assets like crypto and NFTs as properties, their tax value depends on capital gains and losses.

In the US, whenever you trade crypto, your transactions are subjected to taxes. This is because you are using capital to buy another asset. The difference between what you spend to buy cryptocurrencies and what you earn on their sale is what you need to report when filing taxes.

The period for which you own the crypto is also crucial. If you had held onto, say a unit of Ethereum for a year or longer, it would be entitled as a long-term capital gain. Contrarily, digital assets transactions done within a year are considered short-term gains.

Such differences, along with your overall taxable income, affect the tax rates.

Reporting your cryptocurrencies

Companies have started using virtual currencies as a payment option. This might mean getting crypto as paychecks. Regardless of what and when you earn, you must record its value in U.S. Dollars and file them on your tax returns.

As IRS says: “A taxpayer who receives virtual currency as payment for goods or services must, in computing gross income, include the fair market value of the virtual currency, measured in U.S. dollars, as of the date that the virtual currency was received.”

Filing your crypto gains/losses works similarly to investing in other forms of property. Here are the steps to follow for filing your taxes.

# 1: Calculate your gains & losses

Each time you transact using crypto, you incur some gains and losses. To calculate them, you need to track the total difference between when you sold them vs. when you received them.

# 2: Fill out the Form 8949

Form 8949 of IRS is for reporting the disposal and sale of assets. While you have to report all of your capital gains/losses, the following information is needed for each transaction;

· The description of the property you sold

· The date of originally acquiring the property

· The date of the property’s disposal

· Proceeds from fair market value

· Your costs for the property’s purchase

· Your gains and losses

# 3: Include your total gains through Schedule D

The next step is to include your net gains/losses on Schedule D.

Schedule D lets you report your total gains/losses from every source. Other line items noted on Schedule D entail Schedule K-1s from businesses, trusts, and estates, in addition to the short & long-term gains from 8949 and your crypto activities.

# 4: State your cryptocurrency income

When crypto is earned through staking, mining, work, or referral, bonuses get recognized as income and thus are subjected to taxes.

Forms like Schedule A/B/C can be used to report your cryptocurrency incomes; however, the form choice depends on your situation.

# 5: Finish the rest of the tax return forms

Now that you’re done with all steps, you must be finished with reporting all your virtual assets-related transactions. Just finish the rest of your tax return forms, and you are ready to file your tax return to IRS.

Ending up

Despite cryptocurrencies’ anonymous nature, IRS has plenty of ways to track your crypto activity. So, it’s better to report all your activities while filing your tax returns diligently.

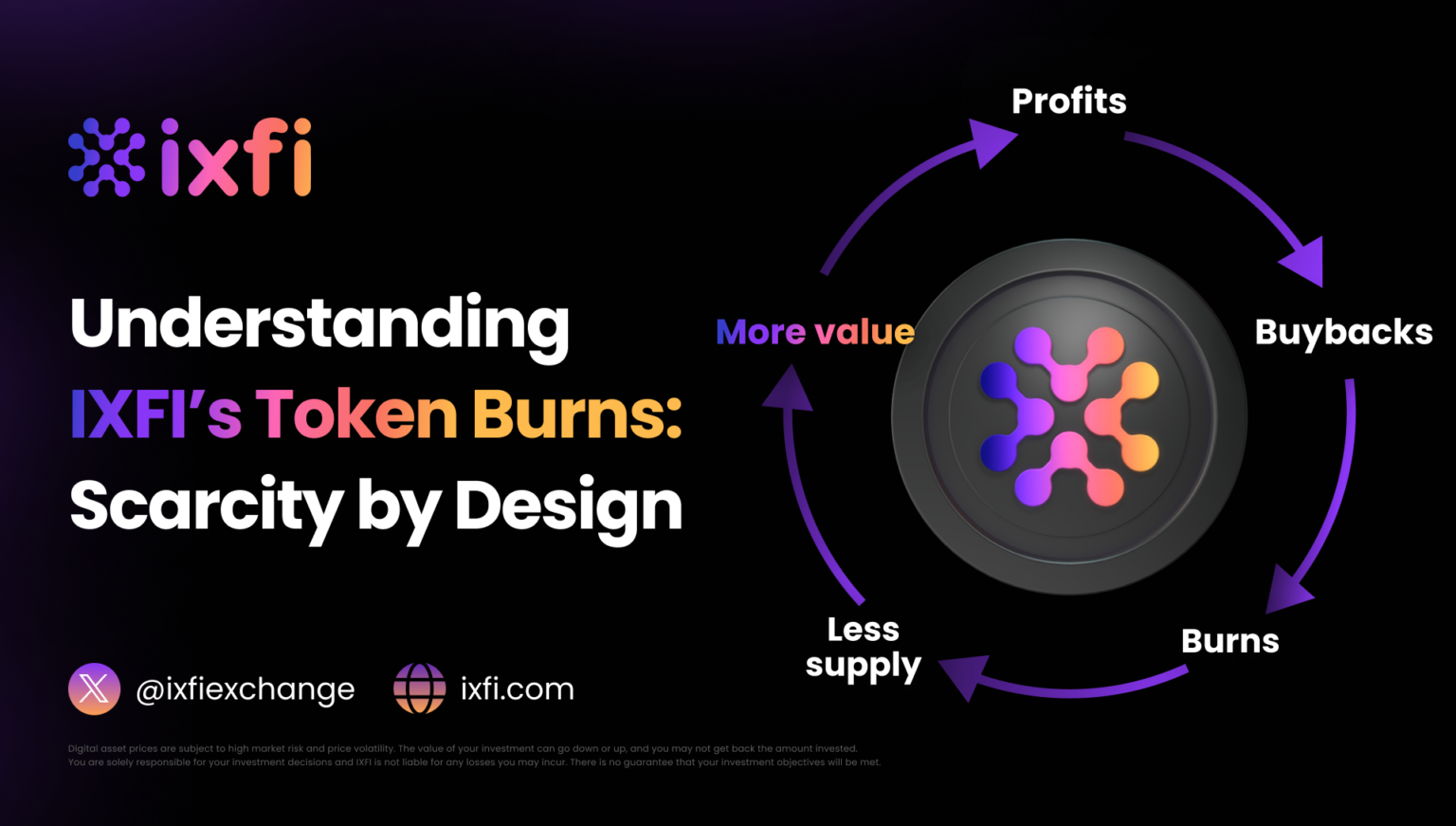

Trading with a trusted exchange partner is safer and more convenient than the alternative. Register on IXFI and enjoy the benefits of a modern, advanced, and easy-to-use platform. Your Friendly Crypto Exchange opens up a world of possibilities for you. Are you ready to seize them?

Disclaimer: The content of this article is not investment advice and does not constitute an offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial and fiscal circumstances.

Although the material contained in this article was prepared based on information from public and private sources that IXFI believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and IXFI expressly disclaims any liability for the accuracy and completeness of the information contained in this article.

Investment involves risk; any ideas or strategies discussed herein should therefore not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial and fiscal objectives, needs and risk tolerance. IXFI expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.