The U.S. government’s decision to create a Strategic Bitcoin Reserve marks a historic moment where national financial policy intersects with the crypto market. Announced yesterday, this initiative involves the United States establishing a stockpile of Bitcoin (much like its strategic petroleum reserves) as a safeguard and strategic asset. The move is aimed at ensuring the financial independence of digital assets in the economy, signaling unprecedented institutional validation for Bitcoin. Notably, the U.S. government already held a considerable amount of about 200,000 BTC from past seizures (worth over $20 billion at the time), providing a head start for this reserve.

This announcement came on the heels of a period of significant market speculation and volatility. Mere talk of a possible U.S. Bitcoin reserve in late 2024 had helped send Bitcoin’s price to new highs and kept it near all-time highs. In other words, investors were highly sensitive to policy news, and the official confirmation of a U.S. strategic reserve only amplified this turbulence. Bitcoin’s price tumbled dramatically on the news, reflecting uncertainty in the market. As the attached chart illustrates, volatility spiked around the time of the announcement – with Bitcoin surging and then plunging within a short span.

Short-term impact: Immediate market reaction

The immediate reaction of the crypto market to the strategic reserve announcement was extreme volatility. Bitcoin’s price initially jumped from around $85,000 to nearly $95,000 on the news, but this rally was short-lived. Within a day, the price reversed and fell back below the $85,000 mark, a round-number level that many traders view as a psychological support. This swift turnaround wiped out most of the initial gains, exemplifying a classic “buy the rumor, sell the news” scenario. Early optimism gave way to profit-taking as short-term traders quickly sold into the rally to lock in gains, causing a rapid price pullback.

Several factors explain this whiplash reaction. First, market psychology and technical trading played a role: round figures like $85,000 tend to act as magnet levels where many stop-loss and take-profit orders cluster. When the price spiked toward $95K, it likely triggered profit-taking sell orders; subsequently, the drop to the mid-$80Ks may have hit stop-loss levels, accelerating the fall. Analysts noted that the frenzy liquidated over $225 million in leveraged positions within hours, underscoring how leveraged traders were caught off guard by the abrupt reversal.

Secondly, uncertainty about implementation tempered the initial euphoria. After the dust had settled, investors started to realize that establishing a U.S. Bitcoin reserve would not happen overnight. The announcement faces regulatory and logistical hurdles as it would require congressional approval and time to implement. This reality check prompted some traders to reassess their exuberance, contributing to the price retreat. In essence, the market surged on the bold vision but then recoiled upon recognizing the practical challenges ahead.

It’s also worth noting that broader market conditions contributed to the volatility. Around the time of the announcement, other developments (such as U.S. trade tariff news and stock market weakness) created a risk-off environment. This macro uncertainty likely exacerbated Bitcoin’s swings as traders speculated about multiple sources of news. The convergence of a major crypto-specific announcement with wider economic jitters led to seesaw price action. In summary, the short-term impact of the U.S. strategic reserve news was a rollercoaster ride for Bitcoin’s price, driven by speculative fervor followed by a dose of caution and profit-taking.

Long-term perspectives: Possible scenarios

In the wake of the initial turmoil, attention has turned to the long-term implications of the U.S. establishing a Bitcoin reserve. Here are a few key scenarios and considerations for the months and years ahead:

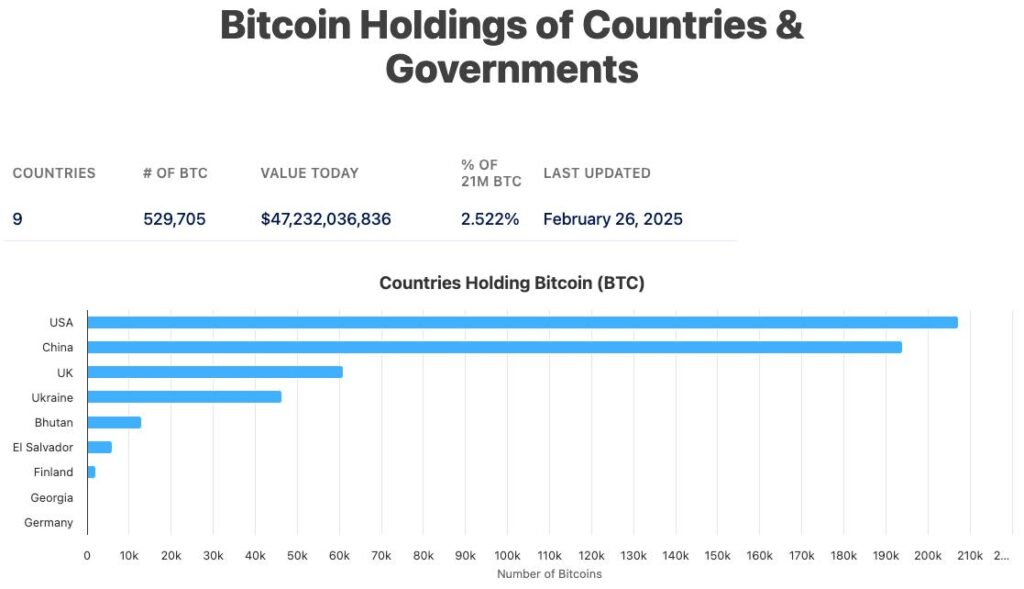

- Precedent for other governments: Perhaps the most significant question is whether the U.S. move will inspire other governments to follow suit. There is a real possibility of a domino effect. In fact, even before this decision, several nations were already exploring or implementing their own Bitcoin reserves. For example, Poland and Brazil have seen proposals for sovereign Bitcoin reserves, and smaller countries like El Salvador and Bhutan have been accumulating BTC as national assets. If the U.S. formally adopts Bitcoin as part of its strategic reserves, it could accelerate a global trend, spurring allies and rivals alike to accumulate Bitcoin to avoid falling behind. This scenario resembles a new kind of “digital gold rush” on a nation-state level, as countries seek to strengthen their financial positions with crypto assets.

- Institutional acceptance and adoption: The creation of a U.S. Bitcoin reserve could also set a powerful precedent for institutional acceptance of cryptocurrency. By treating Bitcoin as a strategic asset, the U.S. government is effectively legitimizing it in the eyes of traditional investors and institutions. We may see an uptick in institutional adoption; not just governments, but corporations, pension funds, and banks might feel more confident adding Bitcoin to their balance sheets or investment portfolios. Analysts have noted that such policy moves could pave the way for substantial institutional adoption of Bitcoin, potentially integrating it as a staple in mainstream financial portfolios. Over time, this could enhance Bitcoin’s stability and reduce perceived risk, as more participants view it as a long-term store of value rather than a speculative toy.

- Global crypto reserve race: We could also witness the emergence of a global strategic crypto reserve race. If multiple countries begin accumulating Bitcoin as a strategic resource, demand for BTC could surge in the long run, potentially driving prices higher due to Bitcoin’s limited supply. Today, governments worldwide collectively hold about 2.5% of Bitcoin’s total supply (around 529,000 BTC). This percentage could climb if more nations start stockpiling crypto. A coordinated wave of national Bitcoin buying might even introduce a new kind of volatility, one driven by geopolitical finance. On one hand, Bitcoin’s status as “digital gold” would be cemented as it becomes a standard part of central bank or sovereign wealth reserves. On the other hand, questions arise: Will countries compete to buy dips, potentially stabilizing price floors? Or could they coordinate policies to manage Bitcoin’s price, similar to how OPEC manages oil supply? It’s uncharted territory. Some skeptics caution that if a few large governments hold outsized BTC reserves, it could concentrate ownership and give those players influence over the market. However, proponents counter that widespread government adoption would ultimately reinforce Bitcoin’s narrative as a resilient store of value on par with gold, a commodity that nations have long held in reserves for stability.

In the long term, the U.S. Strategic Bitcoin Reserve could prove to be a double-edged sword for the crypto ecosystem. It has the potential to greatly boost adoption and integration of Bitcoin into the global financial system, but it also introduces new dynamics (like government influence in crypto markets) that stakeholders will closely watch. Overall, this bold initiative is likely to be a net positive for Bitcoin’s legitimacy. It establishes a precedent that may nudge other governments and institutions toward crypto, possibly ushering in an era where Bitcoin is treated as a strategic asset worldwide. Yet, investors and analysts will be observing how the plan is executed and whether it lives up to its promise – or if bureaucratic and regulatory hurdles diminish its impact.

Implications for investors and traders

For cryptocurrency investors and traders, the advent of a U.S. strategic Bitcoin reserve is a significant development that warrants a strategic response. Big news events like this can create both opportunities and risks, especially given the heightened volatility. Here’s how market participants can consider reacting and positioning themselves:

- Stay informed but avoid hype-driven decisions: It’s crucial to keep track of official announcements, policy changes, and market reactions in the wake of this news. However, traders should be wary of trading on emotion or hype. The initial price spike and crash around the announcement illustrate the danger of knee-jerk reactions. Instead of FOMO (fear of missing out) or panic-selling, take a step back and analyze the situation rationally. Often, the initial market move can be an overreaction, so disciplined traders might wait for confirmation or stabilization before jumping in. Continuing to monitor developments (such as government meetings, regulatory approvals, or other countries’ responses) will help traders anticipate the next phase of market impact.

- Risk management is key: Whenever a single news event can swing Bitcoin’s price by 10%+ within hours, it’s a reminder that risk management is important. Traders should reassess their position sizes. One strategy is to use a wider stop-loss to allow room for normal volatility while still protecting against extreme downside. Also, ensure you have some buffer capital; avoid putting all your trading funds on the line at once. The goal is to survive and stay in the game even if the market takes an unexpected turn.

- Use stablecoins and hedge when needed: In fast-moving situations, having a portion of your portfolio in stablecoins (like USDC) can be a smart way to hedge. For instance, if you anticipate increased volatility or a potential downturn after a big announcement, you might temporarily convert some holdings to a USD-pegged stablecoin. Trading the BTC/USDC pair is a convenient way to do this: it allows you to quickly move into a dollar-equivalent position (USDC) to ride out turmoil and then move back into BTC when you decide the time is right. This way, you can lock in gains or limit losses without fully cashing out of the crypto ecosystem.

- Take advantage of volatility: Volatility isn’t just a risk; it can also be an opportunity. Skilled traders thrive on price swings. With Bitcoin bouncing between levels (like it did between ~$95K and ~$85K in the news aftermath), there are chances to profit from short-term trades. Consider strategies like range trading (buying near support levels such as a big round number like $85K and selling near resistance levels) if the price consolidates, or breakout trading if Bitcoin moves out of a range (for example, if it decisively breaks above a previous high). Always set clear entry and exit targets. If you’re more of a long-term investor, you might use the volatility to accumulate: set laddered buy orders at lower prices (in case of another dip, you’ll automatically buy the dip) or take partial profits on spikes. By treating volatility as an ally, traders can potentially boost their returns, but this should be done with caution and clear strategy.

By following these principles: staying informed, managing risk diligently, and using hedging tools, investors and traders can navigate an event like the U.S. strategic Bitcoin reserve announcement more confidently. The overarching advice is to remain disciplined and adaptable. Big market-moving news can be intimidating, but with the right approach, traders can protect themselves and even find ways to profit from the volatility.

Conclusion

In conclusion, the U.S. decision to establish a Strategic Bitcoin Reserve is an important moment for the crypto market. In the short term, it has injected substantial volatility and a mix of euphoria and caution into Bitcoin trading. In the long term, it could pave the way for the acceptance of cryptocurrencies, potentially influencing other governments and large institutions to embrace Bitcoin as part of their financial strategy. This development indicates how crypto is maturing into a critical piece of the global financial puzzle, one that even nation-states are now actively considering in their economic security plans.

For crypto enthusiasts, traders, and investors, this is a time of both opportunity and vigilance. As discussed, volatility can be used with careful risk management and smart trading tactics. Whether you’re a day trader looking to capitalize on price swings or a long-term believer in Bitcoin’s future, adapting to these market changes is key. Remember that events like these highlight the importance of having a reliable platform to execute your strategy.

If you’re looking to trade Bitcoin during these dynamic times, do so on IXFI’s crypto exchange. IXFI provides a secure, professional environment with high liquidity and fast execution, even in volatile conditions. The platform’s features are designed to help you manage risk and seize opportunities as they arise. By trading the BTC/USDC pair on IXFI, you can easily switch between Bitcoin and a stablecoin, which is ideal for managing volatility while staying in the crypto market. Plus, with low fees and 24/7 support, you can trade with confidence that the platform will support you through turbulent market movements.