Ethereum Merge: A significant event took place in the crypto space, as Ethereum – one of the foremost crypto projects- is set to change its network security. Ethereum is secured with a Proof of Work mechanism that requires hardware processing to solve complex equations to mine the next block in the Blockchain. The Proof of Stake transformation will remove miners’ need to compete for block rewards. Instead of block rewards, node operators will be required to stake 32 ETH as collateral to earn rewards as network validators.

This switch could reduce Ethereum’s energy consumption by over 99 percent. Energy consumption is not the only issue The Merge is looking to solve. It is expected that transactions will be faster, although this improvement may be marginal. This milestone could also boost investors’ sentiment and inject some optimism after months of market volatility caused by factors such as inflation and rising interest rates, among others.

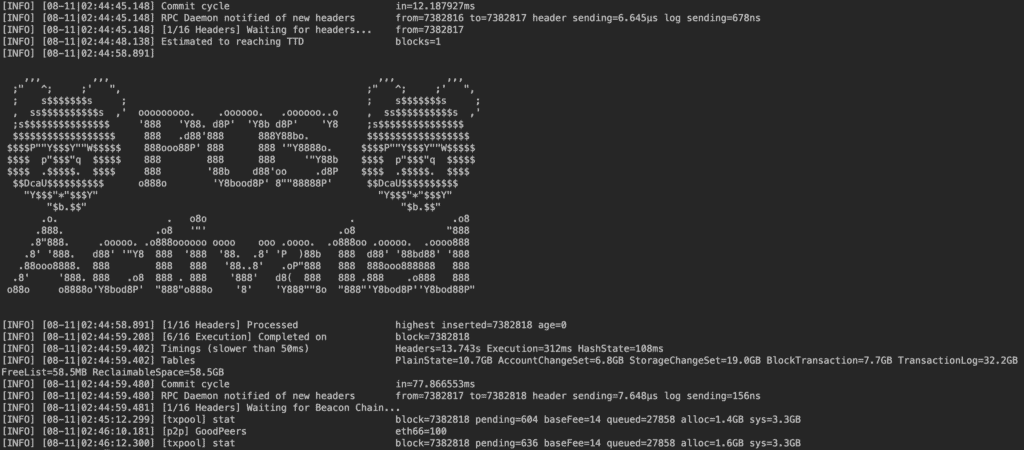

And we finalized!

Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

— vitalik.eth (@VitalikButerin) September 15, 2022

Why The Merge is a crucial event for Ethereum

The Ethereum merge process started in late 2020 when the Beacon chain officially launched the Proof of Stake version of Ethereum. The Merge happened on the 15th of September. This will end the Proof of Work consensus and start focusing on the Proof of Stake chain. The overall transformative journey of Ethereum does not conclude with The Merge.

According to Ethereum co-founder Vitalik Buterin, the event places Ethereum’s transition slightly over halfway through — 55% of the way there, to be exact. The following key objective for Ethereum is sharding, which seeks to increase scalability by dividing the network into parallel sections.

There will be a significant decrease in the amount of Ethereum issued as block rewards. Currently, an average of 13,000 ETH are mined each day. This amount will decrease to roughly 1,600 Ether each day after The Merge. As a result, the inflationary growth of Ether has been slowed by 90%. When The Merge is finished, there will be no distinction between ETH 1 and ETH 2, which have been renamed “the execution” and “consensus layers”, respectively.

The market forecast for ETH post-Merge

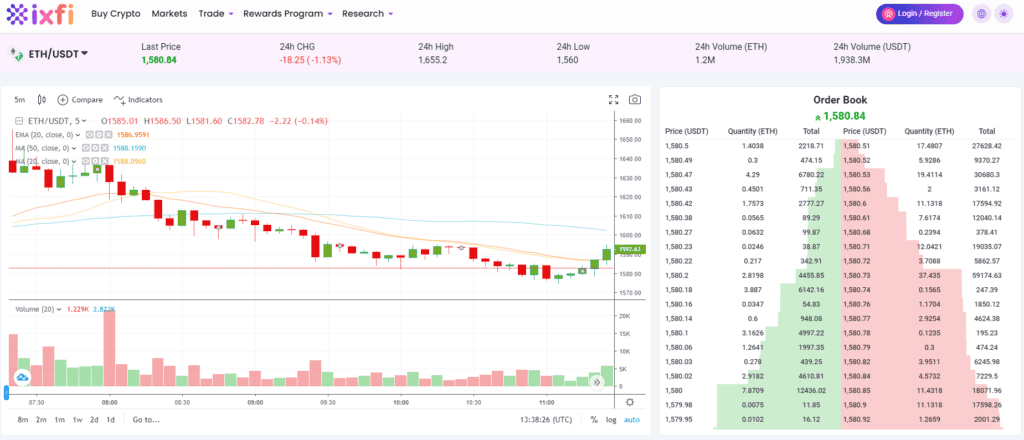

It has been speculated that Ethereum’s price could go either way. Some are expecting prices to increase while others are expecting the opposite. The price of ETH moved less than 1% to $1,605 during the first few minutes after the merge, remaining effectively flat during the Asian trading session. What is evident is that the market forecast for ETH post-Merge is not particularly specific, even after accounting for the possibility of deflationary monetary policy and increased Blockchain developer activity.

ETH issuance is expected to fall by 90%, total token supply may fall after burning, and network activity is taken into account. However, it is unclear how much this fact is already priced into Ethereum. Furthermore, existing miners may fork a Proof of Work chain from Ethereum’s main net, complicating matters.

The Merge is unlikely to reduce gas fees in the short term because the upgrade entails a shift in the consensus mechanism – the way Ethereum validates transactions – rather than an increment or growth of its capabilities. The Merge will not directly impact gas fees because they are a natural consequence of demand vs. network capacity rather than the way the Blockchain validates transactions.

Ethereum’s Merging aims for more positive outcomes

As previously stated, The Merge is expected to improve the Blockchain’s energy efficiency. According to its website, Ethereum’s carbon emissions are comparable to Singapore’s, and its total energy consumption is reasonably similar to the Netherlands. The Merge is expected to reduce Ethereum’s carbon footprint, making the platform more appealing to environmentally conscious investors. A successful transition to Proof of Stake would signal to regulatory authorities that the crypto industry can adapt in a way that prioritizes climate change concerns. The Ethereum Merge will most likely spur additional research and partnerships between the cryptocurrency space and regulators.

Disclaimer: The content of this article is not investment advice and does not constitute an offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not consider your individual needs, investment objectives, and specific financial and fiscal circumstances.

Although the material contained in this article was prepared based on information from public and private sources that IXFI believes to be reliable, no representation, warranty, or undertaking, stated or implied, is given as to the accuracy of the information contained herein. IXFI expressly disclaims any liability for the accuracy and completeness of the information contained in this article.

Investment involves risk; any ideas or strategies discussed herein should, therefore, not be undertaken by any individual without prior consultation with a financial professional to assess whether the ideas or techniques discussed are suitable to you based on your personal economic and fiscal objectives, needs, and risk tolerance. IXFI disclaims any liability or loss incurred by anyone who acts on the information, ideas, or strategies discussed herein.