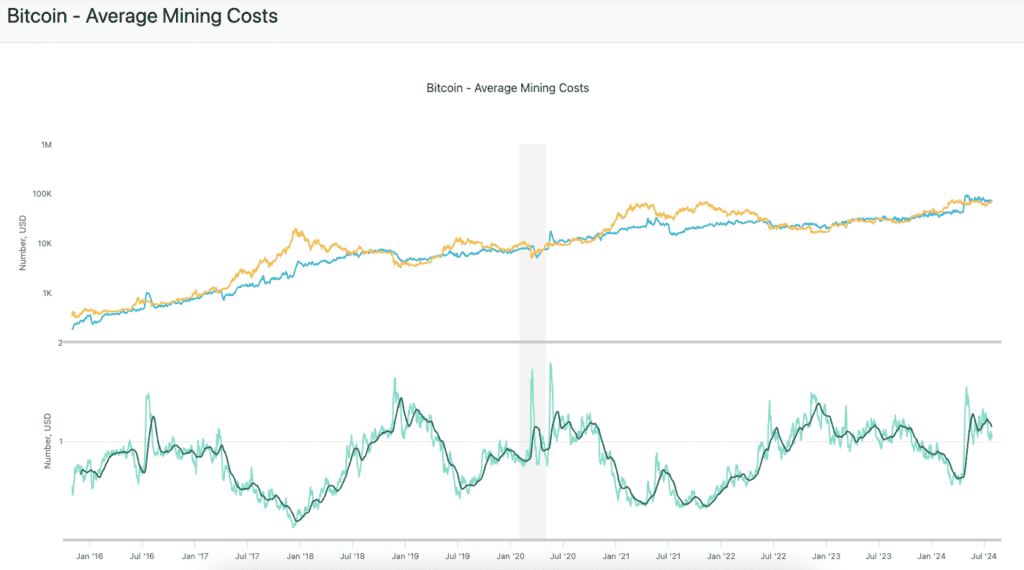

In the crypto world, sustainability has become a key concern. Traditional cryptocurrencies like Bitcoin are often criticized for their high energy consumption and environmental impact. As of 2024, Bitcoin consumes approximately 164 terawatt-hours (TWh) annually, comparable to the energy consumption of entire countries like Egypt. The cost to mine a single Bitcoin is now around $70,000, reflecting significant operational and energy expenses. This high energy consumption and cost underscore the urgent need for more sustainable options within the crypto space.

The environmental impact of Bitcoin

Bitcoin’s Proof of Work (PoW) consensus mechanism, which requires miners to solve complex mathematical problems to validate transactions and secure the network, is the primary driver of its high energy consumption. This process demands substantial computational power, leading to significant carbon emissions. Here is a graphical representation of Bitcoin’s energy consumption:

The rise of eco-friendly cryptocurrencies

Ethereum 2.0 (ETH)

Ethereum’s transition from PoW to Proof of Stake (PoS) with Ethereum 2.0 marks a significant milestone in the crypto world. PoS reduces energy consumption by over 99%, as it eliminates the need for energy-intensive mining. Instead, validators are chosen based on the number of coins they hold and are willing to stake as collateral. This shift not only enhances Ethereum’s scalability and security but also significantly reduces its carbon footprint.

• Market capitalization: Approximately $406 billion as of July 2024.

• Launch date: December 1, 2020 (Beacon Chain).

• Use cases: Smart contracts, decentralized applications (dApps), and DeFi platforms.

• Advantages: Significantly lower energy consumption, improved scalability, and enhanced security.

• Challenges: Transitioning to PoS was complex, and maintaining decentralization is an ongoing challenge.

Cardano (ADA)

Cardano, developed by Input Output Hong Kong (IOHK), has used the PoS mechanism since its inception. The network’s Ouroboros protocol is designed to be highly energy-efficient while maintaining robust security. Cardano’s commitment to sustainability extends beyond its consensus mechanism, with initiatives aimed at promoting environmental and social governance (ESG) principles.

• Market capitalization: Around $15 billion as of July 2024.

• Launch date: September 29, 2017.

• Use cases: Smart contracts, decentralized applications, and identity management.

• Advantages: Energy-efficient PoS mechanism, strong emphasis on academic research and peer-reviewed development.

• Challenges: Slow and methodical development process, which sometimes delays updates.

Solana (SOL)

Solana utilizes a unique hybrid consensus model combining PoS and Proof of History (PoH). This design ensures high throughput and energy efficiency. Solana’s network can handle thousands of transactions per second with minimal energy expenditure, making it one of the most sustainable and scalable blockchain platforms available.

• Market capitalization: Approximately $90 billion as of July 2024.

• Launch date: March 2020.

• Use cases: High-frequency trading, decentralized exchanges, and NFTs.

• Advantages: High transaction speeds, low fees, and minimal energy consumption.

• Challenges: Network outages and centralization concerns.

Benefits of investing in eco-friendly cryptocurrencies

• Lower environmental impact: By choosing cryptocurrencies that use PoS or similar energy-efficient mechanisms, investors can reduce their carbon footprint and support sustainable practices within the industry.

• Regulatory compliance: As governments and regulatory bodies increasingly focus on environmental sustainability, eco-friendly cryptocurrencies are more likely to comply with future regulations and standards.

• Innovation and growth: Projects like Ethereum 2.0 and Cardano are at the forefront of blockchain innovation, offering improved scalability, security, and functionality, which can translate into long-term growth and stability for investors.

• Community support: Eco-friendly cryptocurrencies often have strong community backing and partnerships with environmental organizations, enhancing their credibility and appeal to socially conscious investors.

Conclusion

As the cryptocurrency industry continues to grow, the shift towards sustainability is not just a trend but a necessity. Eco-friendly cryptocurrencies like Ethereum 2.0, Cardano, and Solana are leading the way in reducing digital currencies’ environmental impact. By investing in these sustainable options, individuals can contribute to a greener future while potentially benefiting from the innovation and growth these projects offer.

For those looking to make environmentally conscious investment choices, these eco-friendly cryptocurrencies provide a promising path forward.