Ethereum ETFs have made significant steps in 2024, offering investors new ways to gain exposure to one of the most critical assets in the cryptocurrency space. The approval of Ethereum ETFs marks a milestone following the success of Bitcoin ETFs. This move by regulatory bodies signifies a growing acceptance of digital assets in traditional financial markets.

Ethereum ETF approval and market reaction

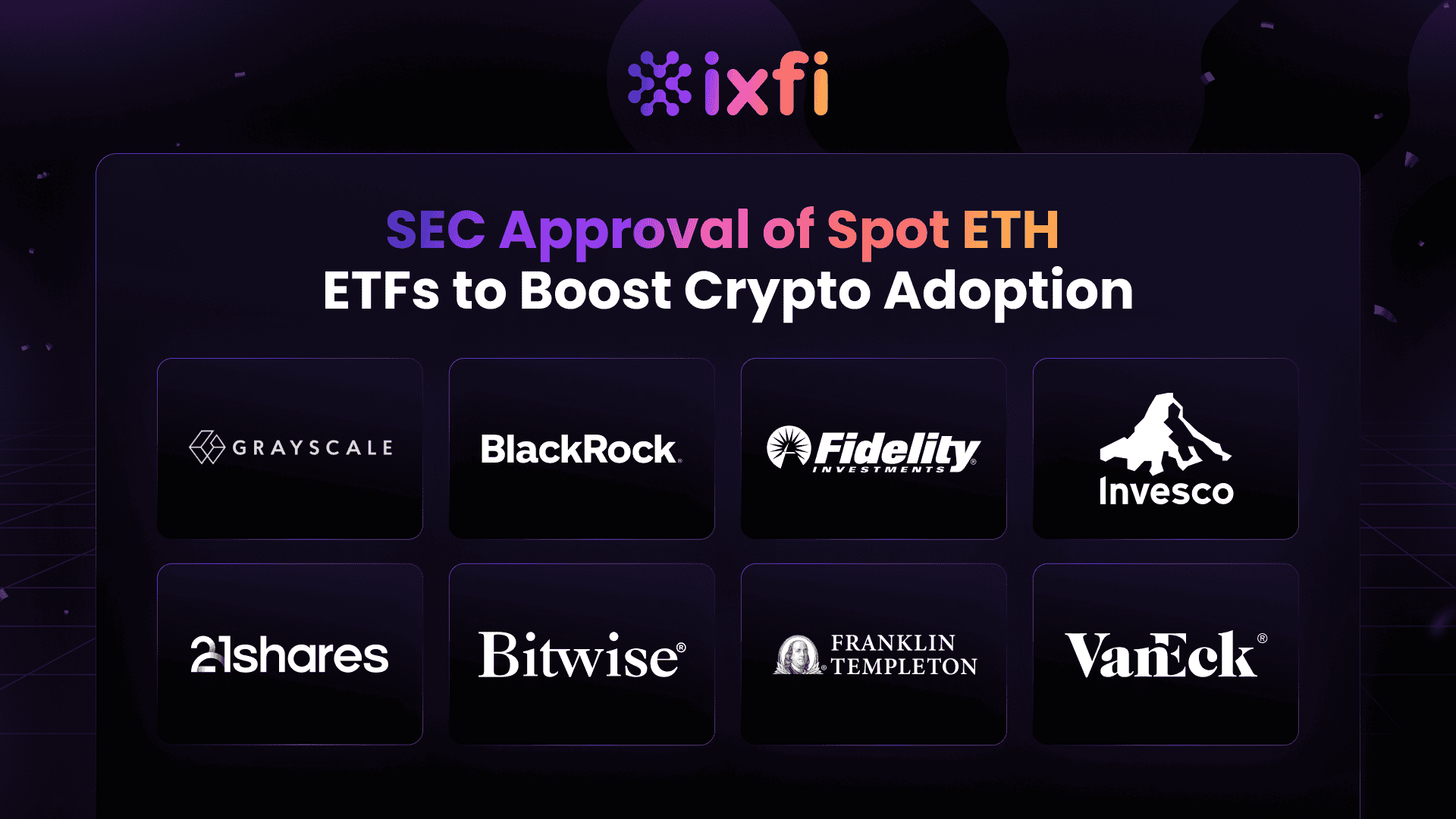

In May 2024, the U.S. Securities and Exchange Commission (SEC) approved the first Ethereum ETF, sparking significant interest and activity in the market. On the day of the announcement, Ethereum’s price surged by approximately 20%, demonstrating strong investor confidence in the asset’s future. The ETF will provide a new avenue for institutional and retail investors to engage with Ethereum without directly holding the cryptocurrency.

Performance of Ethereum

Since its launch, Ethereum has seen substantial inflows, highlighting the growing interest in ETH as a critical component of diversified investment portfolios. Year-to-date (YTD), Ethereum has appreciated 52% against the U.S. Dollar, showcasing its resilience and growth potential despite market fluctuations. However, compared to Bitcoin, Ethereum has underperformed, recording a 3% decrease relative to Bitcoin’s performance over the same period.

Impact on the market and investors

The introduction of Ethereum ETFs has had a profound impact on the market. It has legitimized Ethereum as a viable investment option and provided a regulated, secure way for investors to gain exposure to the asset. This development has attracted institutional investors who were previously hesitant due to regulatory uncertainties and the complexities of holding and securing digital assets.

The ETFs will also contribute to increased liquidity in the Ethereum market, making it easier for large investors to enter and exit positions without causing significant price disruptions. This added liquidity can reduce volatility and create a more stable trading environment for all participants.

Future prospects

Looking ahead, the approval of Ethereum ETFs is likely to pave the way for further innovation in the digital asset space. As more investors become comfortable with these financial instruments, we can expect to see a broader range of ETFs and other derivative products that provide exposure to Ethereum and other cryptocurrencies.

In conclusion, the launch of Ethereum ETFs marks a pivotal moment in the evolution of digital asset investment. By providing a regulated, secure way to invest in Ethereum, these ETFs have opened the door to a broader range of investors and significantly contributed to integrating cryptocurrencies into traditional financial markets. The positive market response, highlighted by the substantial price increase following the ETF approval, underscores the growing confidence in Ethereum’s long-term potential.

Follow us on X (Twitter) to stay informed about the latest trends and updates in the cryptocurrency market. Don’t miss out on the future of digital asset investments.