After a volatile start to March, the cryptocurrency market is showing convincing signs of life. A recent local bottom on March 11, 2025, has many traders thinking this could be a strong buying opportunity. Prices dipped hard but have rebounded pretty well, suggesting that the worst might be over for now. In this article, we analyze four key cryptocurrencies: Bitcoin, Solana, Bittensor, and Ripple – to see why the market is looking good here. We’ll break down each coin’s recent price action in simple terms and discuss what might be coming next.

Bitcoin: Bouncing back from the bottom

Bitcoin (BTC) has surged off its recent lows, leading the market recovery. On March 11, BTC hit a local low of around $76,600, given the general sell-off of the whole crypto market (and risk assets). Fast forward to today (March 14), and Bitcoin has climbed back up in a big way: it opened the day at $80,100 and rallied to an intraday high of $83,800. That’s roughly a 9% bounce from the low in just a few days. This strong rebound indicates that buyers stepped in aggressively around the high-$70k range, treating it as a solid support zone.

From a technical perspective, Bitcoin’s chart looks encouraging, yet it still has some resistance ahead. The fact that it reclaimed $80,000 so quickly is a positive sign: it suggests the market believes that level should now act as a support. The momentum is currently leaning bullish. Traders will be watching to see if BTC can break above the next notable resistance (around the $84k level) to confirm that a sustained uptrend is underway. For now, the trend appears to be in the bulls’ favor, with higher highs and higher lows forming in the aftermath of that March 11 bottom. As long as Bitcoin holds above the $80k zone on any pullbacks, the chart remains optimistic.

On the other hand, it’s worth remembering that Bitcoin is still down from its peak (it was about 24% off the January all-time high as of yesterday). Some caution is warranted until it makes a definitive move past its nearby resistance. However, the current price action, a strong bounce on good volume, gives credible hope that the market has indeed found its support for now. In short, Bitcoin is looking strong here, and its resilience is setting a tone for the rest of the crypto market.

Solana: Quick recovery after a sharp dip

Solana (SOL) also experienced a significant drop in early March but has shown an impressive recovery since then. During the sell-off, Solana plunged to about $112 at its lowest point. However, it didn’t stay down for long, as the price quickly bounced back into the $120s after the crash. In fact, on March 12, Solana even briefly hit a high of around $131 before encountering some resistance and pulling back slightly. This swift rebound off the lows shows that buyers were eager to scoop up SOL when it dipped into the low $100s.

From a technical standpoint, the $112 level now stands out as an important support zone for Solana. The market clearly rejected prices below that, as evidenced by the quick jump back above $120. Solana’s ability to reclaim and hold the $120+ range is a sign of returning bullish momentum. To keep this uptrend going, Solana will need to break through its next resistance around the mid-$130s. If it can close above ~$130 with strength, that would likely open the door to a bigger move higher (perhaps aiming for the $150s next). On the downside, holding above $120 will be key; as long as SOL stays above that, traders and investors can feel confident that the bulls remain in control.

Bittensor: One of the top gainers this week

Bittensor (TAO) might not be a household name, but it has been making waves during the rebound. This AI-focused cryptocurrency was among the top gainers immediately after the market’s downturn. Bittensor’s price plunged to around $213 at the start of the week, but within a couple of days, it rocketed up roughly 15%, reaching about $260–$270 during the bounce. That’s a big move in a short time, and it suggests there’s significant interest in TAO whenever its price dips. In fact, Bittensor’s jump was so sharp that it outpaced many larger coins, showcasing the kind of volatility (and opportunity) that smaller altcoins can offer.

In technical terms, Bittensor still has some ground to cover to fully reverse its longer-term downtrend. Before this rebound, TAO was down about 45% year-to-date. The recent bounce is an encouraging sign, but some indicators are telling us to stay cautious. In simpler words, the short-term price action is positive, but Bittensor hasn’t totally erased the prior bearish pressure. To really impress traders, TAO would need to break above some higher resistance levels: for instance, climbing past $300 (a level it traded near before the recent drop) would indicate a trend reversal.

Altseason: What to expect for Altcoins?

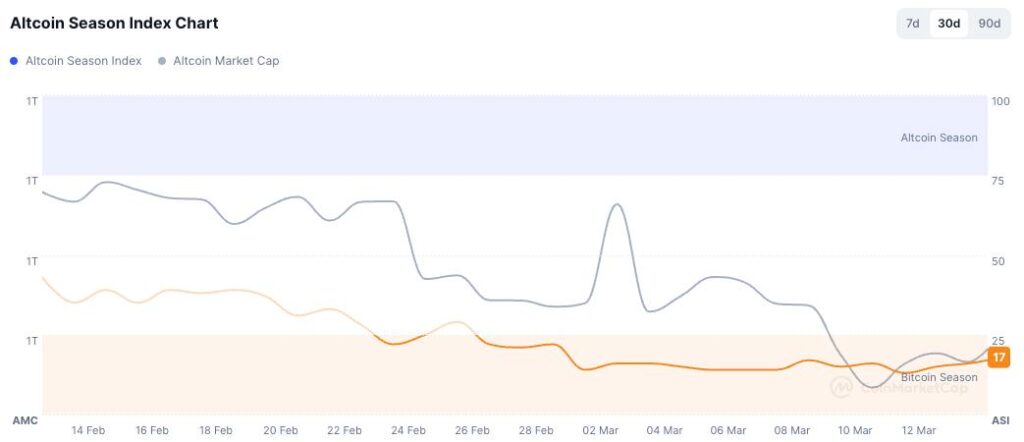

Now, let’s talk altseason. In crypto lingo, altseason refers to a period when alternative coins (basically any crypto that isn’t Bitcoin) start to significantly outperform Bitcoin. It’s an exciting time for crypto investors because that’s when you often see big gains in many smaller projects. Typically, altseasons tend to occur after Bitcoin has had a strong run or when BTC is taking a breather after a big move. The idea is that as Bitcoin’s rally cools off or consolidates, traders rotate some of their profits into altcoins, causing a pump in the altcoin market.

Coins like Solana and Bittensor, as we discussed, bounced 10-20% off their lows, which is a bigger increase than Bitcoin’s 9%. This kind of price action is a classic altseason clue: it shows that once Bitcoin is steady, investors quickly start hunting for bigger wins in the altcoin space.

If this trend continues, we could indeed be entering an altseason. In the upcoming period, expect strong alternative projects to potentially outperform Bitcoin. That doesn’t mean Bitcoin will stagnate; it just means altcoins might rise faster in percentage terms. We might see the total market cap of altcoins grow at a quicker clip, and Bitcoin’s dominance could start to decline as money flows into alts. History shows that during altseasons, coins in hot sectors (for instance, AI-related projects) often lead the charge.

The crypto market is looking strong right now. We’ve seen a pivotal bottom on March 11, followed by a quick recovery. Bitcoin is back in a bullish posture, and several major alts are showing even greater strength. The stage might be set for an altseason. For investors, this is a time to pay attention: opportunities abound, but as always, staying informed and being selective with investments will be key. If the current momentum holds, the coming weeks could be incredible for altcoin enthusiasts, all while Bitcoin continues to provide a steady anchor for the market. The crypto market’s message at the moment: Things are looking good here. Let’s see if it can deliver on that promise in the days ahead.