Whale activity, or large-scale Bitcoin holders moving significant amounts of BTC, can profoundly affect cryptocurrency prices. Whales often control a substantial portion of the market, and their actions can trigger shifts that lead to either bullish or bearish trends. Recently, we’ve seen Bitcoin price fluctuations, where movements involving large wallets coincided with price changes.

Whale influence on market sentiment

When a whale moves a large sum of Bitcoin, it signals something significant to the market. For instance, if whales transfer BTC to exchanges, it might suggest they are preparing to sell, creating downward pressure on prices. Conversely, large withdrawals from exchanges can indicate accumulation, signaling confidence in the market’s future and higher prices. Whale wallets have been responsible for approximately 45% of Bitcoin’s liquidity, with the most recent activity showing a clear impact on price, contributing to a 5% increase over the past few days.

Whale behavior can also influence retail investors. The fear of missing out (FOMO) or panic selling often follows significant whale transactions, amplifying price swings. This is particularly true during heightened market volatility, where even small signals can create ripple effects.

Notable whale movements in recent weeks

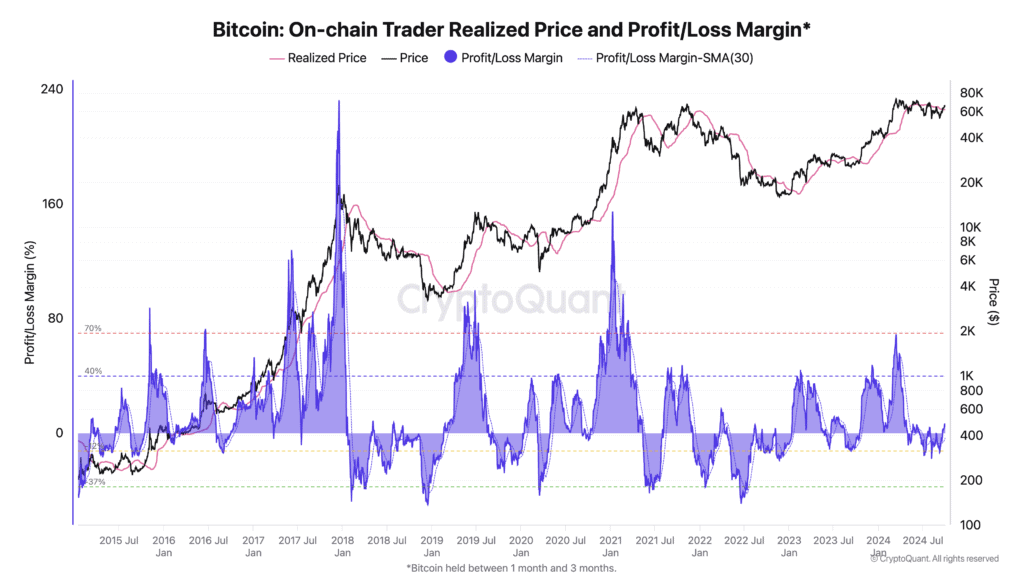

Recent data suggests that large Bitcoin holders have been moving funds, contributing to a 10% price surge/drop in the last 4 weeks. Transactions from wallets holding over 1,000 BTC have notably increased, indicating either profit-taking or new entry points for significant investors.

For example, during a whale-driven sell-off on the 5th of August, Bitcoin’s price fell by 15%, triggering a cascade of stop-loss orders from smaller traders. On the flip side, a significant accumulation phase earlier this month saw Bitcoin rise by 25%, buoyed by whale confidence.

The bigger picture: Long-term implications

Despite short-term volatility, whale activity often reflects long-term sentiment. Historically, large holders have been known to accumulate during dips, signaling confidence in Bitcoin’s long-term value. While these large players can cause temporary disruption, their actions also provide liquidity, helping to stabilize markets in the long run.

Conclusion

Whale activity remains a critical force in shaping Bitcoin’s price movements. Understanding these patterns can provide valuable insights for traders and investors. As more data emerges, tracking whale behavior will remain critical in predicting Bitcoin’s future performance.