Bitcoin’s network is vast, with millions of addresses holding varying amounts of BTC. For investors and traders, understanding where the majority of these addresses stand in terms of profitability can be crucial. Using data from IXFI’s Coin Info Center, we’ll explore the current state of Bitcoin addresses, focusing on how many are in profit and what prices they were purchased at.

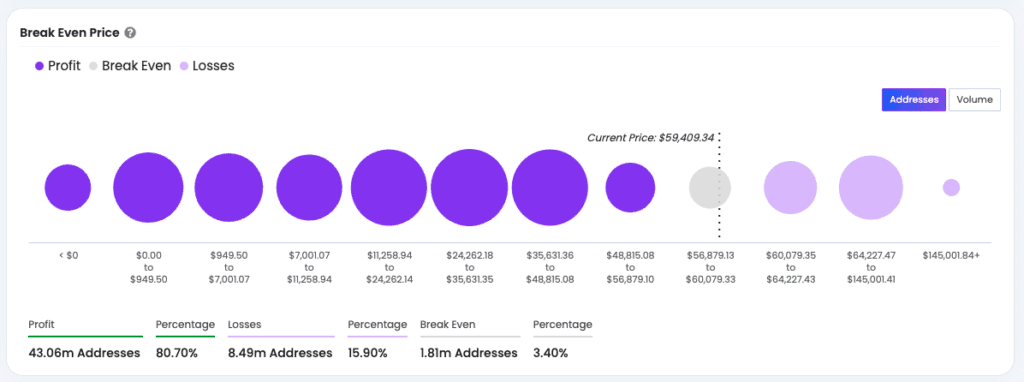

Profitability of Bitcoin addresses

According to the first dataset, currently, 80.70% of Bitcoin addresses are in profit, representing 43.06 million addresses. These addresses are classified as In the Money, meaning the current price of Bitcoin ($59,409.34) is higher than the price at which these addresses acquired their BTC. Meanwhile, 15.90% of addresses (8.49 million) are Out of the Money, or at a loss, with Bitcoin’s current price below their purchase price. The remaining 3.40% (1.81 million addresses) are breaking even.

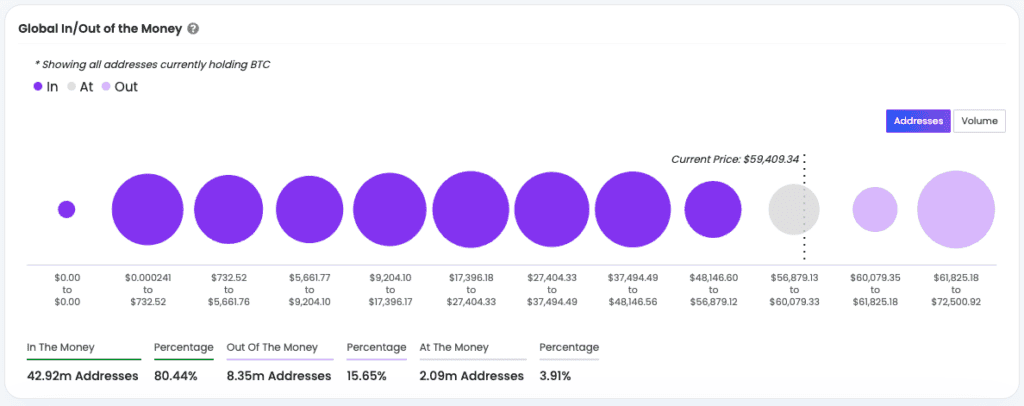

Purchase prices and address distribution

The second dataset dives into the specific prices at which Bitcoin was purchased across different addresses. A significant portion of addresses acquired BTC at prices ranging from $9,204.10 to $17,396.17 and are now well In the Money given the current price. Interestingly, 42.92 million addresses are in profit, which again represents 80.44% of total addresses holding BTC. Another 15.65% of addresses are at a loss, while 3.91% are breaking even.

Conclusion and recommendations

These insights highlight the importance of tracking the profitability and purchase prices of Bitcoin addresses, especially for those making investment decisions. By understanding where the majority of holders stand, traders can make more informed choices. For more detailed analyses like this, check out IXFI’s Coin Info Center. The platform is free and offers valuable data for anyone looking to navigate the complex world of cryptocurrency trading.