Welcome back to another post in our educational series! Today, we explore five DeFi tokens set to make significant impacts in 2024, ranked by their market capitalization.

Bitcoin, the pioneering cryptocurrency, has undergone significant changes since its last halving on April 19, 2024. This event, a crucial aspect of Bitcoin’s monetary policy, reduced the block reward from 6.25 BTC to 3.125 BTC, marking the fourth such event since Bitcoin’s inception. This blog delves into the current state of Bitcoin and its network, highlighting hash power, mining difficulty, number of miners, and the overall impact of the recent halving.

Understanding the Bitcoin Halving

Bitcoin halvings occur approximately every four years, or every 210,000 blocks. These events halve the reward that miners receive for adding new blocks to the blockchain. The first halving took place in November 2012, reducing the block reward from 50 BTC to 25 BTC. The subsequent halvings in July 2016 and May 2020 further reduced the rewards to 12.5 BTC and then to 6.25 BTC, respectively.

Current state of the Bitcoin network

Since the latest halving in April 2024, the Bitcoin network has experienced significant changes:

1. Hash power and mining difficulty

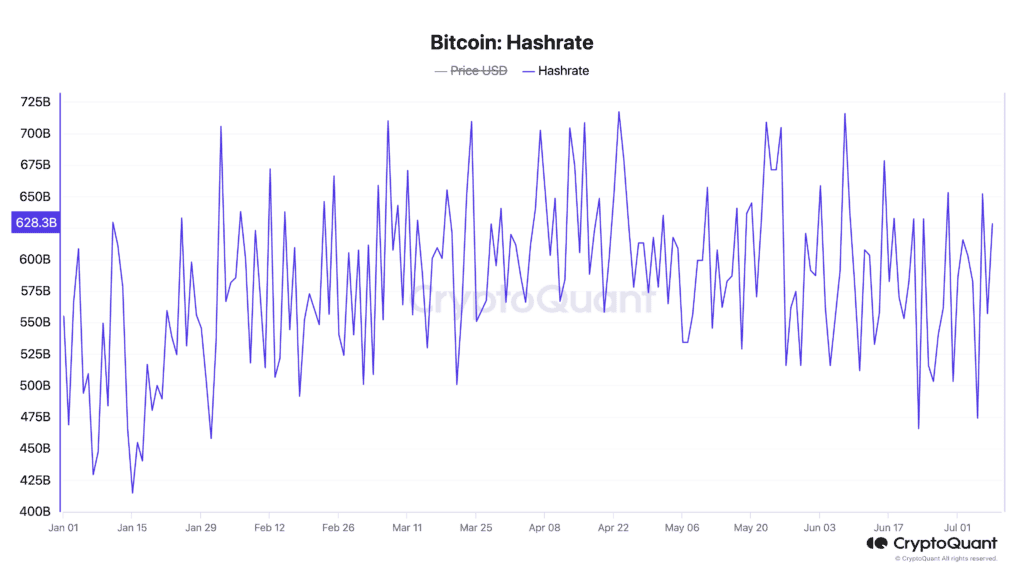

The network’s hash rate has seen notable fluctuations post-halving. As of July 2024, the hash rate stands at approximately 628.32 million terahashes per second (TH/s), up from 425.48 million TH/s a year ago. This increase indicates a robust network with high security and resilience. However, the rise in hash rate also reflects the increased competition among miners, which has driven up the difficulty of mining new blocks.

2. Number of miners

The number of active miners in the Bitcoin network has grown, partly due to the entry of more efficient mining hardware and the involvement of large-scale mining operations. Despite the halving reducing the block reward, many miners continue to participate, attracted by the potential long-term value of Bitcoin and advancements in mining technology that reduce operational costs.

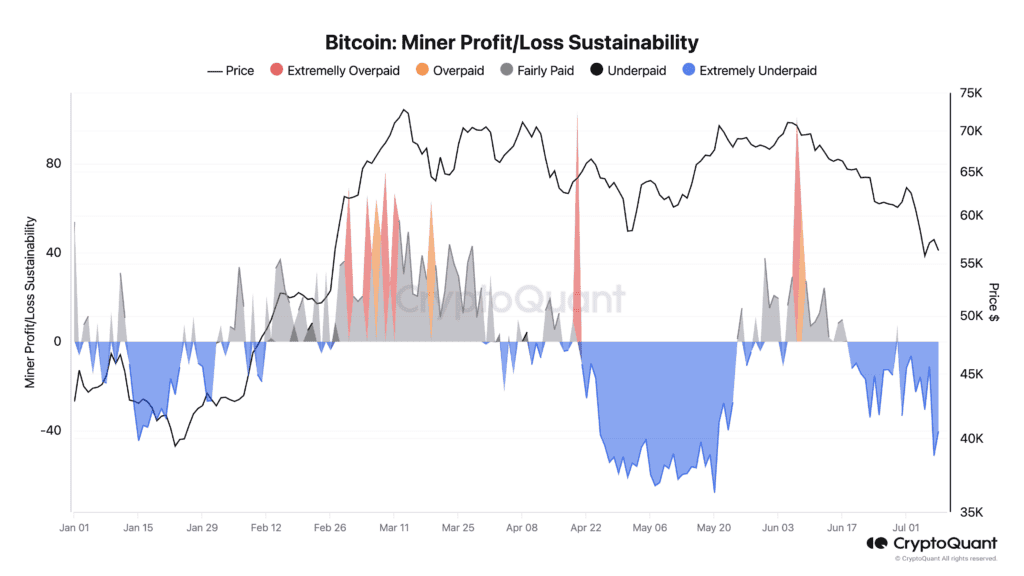

3. Mining costs and profitability

Mining a single Bitcoin has become more costly. Pre-halving, the cost of production was estimated at around $16,800 per Bitcoin. Post-halving, this cost has risen to approximately $27,900, considering factors like electricity prices and equipment efficiency. The increased costs have squeezed less efficient miners, potentially pushing them out of the market and consolidating mining power among more efficient operators.

4. Network resilience and security

The increased hash rate enhances the network’s security by making it more difficult for malicious entities to execute a 51% attack. This resilience is crucial for maintaining trust in Bitcoin’s decentralized nature and its role as a digital store of value.

Impact of the Halving on Bitcoin’s ecosystem

The halving has historically been a bullish event for Bitcoin’s price, often leading to significant price increases due to reduced supply and increased scarcity. Although the immediate post-halving period may see increased volatility and challenges for miners, the long-term outlook generally remains positive. The latest halving is expected to follow this trend, potentially driving up Bitcoin’s price as the market adjusts to the new supply dynamics.

Conclusion

Since the April 2024 halving, Bitcoin’s network has demonstrated remarkable strength and resilience. The increase in hash power and continued miner participation underscore the robust nature of the network. While mining costs have risen, driving some miners out of the market, the overall security and functionality of the network remain strong. As the market continues to evolve, Bitcoin’s halving events play a crucial role in shaping its economic landscape, driving innovation, and ensuring its place as the leading cryptocurrency.

Digital asset prices are subject to high market risk and price volatility. The value of your investment can go down or up, and you may not get back the amount invested.

You are solely responsible for your investment decisions and IXFI is not liable for any losses you may incur. There is no guarantee that your investment objectives will be met.